The Economic Value of Behavioural Targeting in Digital Advertising

1. How digital advertising uses behavioural data

Digital advertising generates annual revenue of €41.9 billion in Europe, growing at a double-digit rate of 12.3% year-on-year in 2016. An increasing percentage of this revenue and underlying growth is attributable to the use of data, and behavioural targeting in particular. Data is fundamentally transforming the mechanisms and procedures that underpin digital advertising in two ways:

- Firstly, data fuels transactional or workflow automation mechanisms that use a set of rules applied by software and algorithms. Commonly known as programmatic advertising, these mechanisms make digital advertising more effective and efficient. Programmatic advertising allows advertising performance to be measured and adjusted in real-time as campaigns evolve. It provides the technology to deliver advertising to users individually within milliseconds, without cumbersome manual processes. On the internet, audiences’ attention is highly fragmented across different websites and apps. Programmatic advertising connects different media properties, such as newspapers, and aggregates their advertising supply. This lowers barriers to market participation for publishers and others looking to secure advertising revenue. Smaller publishers can compete for advertising money that they would otherwise not be able to tap into, because they are not known to advertisers or lack the strong sales force of larger media companies.

- Secondly, data allows to address consumers in a way that is more relevant to their circumstances and experience (targeted advertising). Behavioural data, which could include on-site and off-site browsing, purchase behaviour and signals of intent, allows companies to tailor advertising messages to consumers and reach them when their message is most relevant. This makes advertising more worthwhile and less interruptive for the consumer, and more effective for the advertiser. As people’s tastes, cultural affiliations and life journeys have diversified, traditional criteria for segmenting consumers (age groups, income brackets or occupational status, for example) have become insufficient. Behavioural data allows advertisers to identify and describe new consumer groups, such as ‘auto intenders’ who are seeking to buy a car. This reduces ‘wastage’, or advertising to the wrong consumers, reduces frustration and ensures consumers encounter products and messages that are genuinely useful to them.

Our market model suggests that 86% of programmatic advertising in Europe uses behavioural data. However, behavioural data is also used by 24% of non-programmatic advertising. Behavioural data underpins €10.6 billion of the €16 billion digital display advertising market in Europe today, used either to buy or sell ads. In 2016, 90% of the digital display advertising market growth came from formats and processes that use behavioural data. Extrapolating from current trends, our econometric market model assumes that under present regulatory conditions, the market would grow by 10% annually until 2020 to €23.5 billion. Out of this spend, €21.4 billion will be informed by behavioural targeting. This implies a growth of 106% for digital advertising fuelled by behavioural targeting, and a decline of 63.6% for forms of digital advertising that don’t use such data (see Exhibit 1).

Exhibit 1: Behavioural Targeting Market Size

Behavioural targeting is unevenly distributed across European markets at present. The markets taking the lead are those with high ad spend per capita, where digital has a high share of overall advertising spend. They include the UK, Netherlands, and France. In top markets, behavioural data is used in more than 50% of total digital display ad spend.

In Southern and Eastern European markets, behavioural targeting ranges between 5% and 20% and is lower if social media are excluded. However, interviews with market participants and our econometric model suggest strong uptake that will increase this share to 70% over the next five years. These developments suggest that the proportion of digital ad spend using behavioural targeting will become more consistent across European markets, making digital advertising more competitive in markets where it currently lags.

2. The economic benefits of behavioural data in advertising

The market-shaping impact of behavioural targeting becomes clear when are are able to quantify its effectiveness and efficiency gains, for example through data on the conversion rates of display banner adverts (see Exhibit 2). Behaviourally targeted ads have a click-through rate 5.3x higher on average than standard run-of-network advertising, which does not use behavioural data. When behavioural data is used to retarget people who have paid attention to a product previously, the click-through rate is 10.8x higher. Accustomed to such conversion gains, advertisers now expect the option of behavioural targeting as a prerequisite for spending advertising on digital media channels.

Exhibit 2: Conversion rates

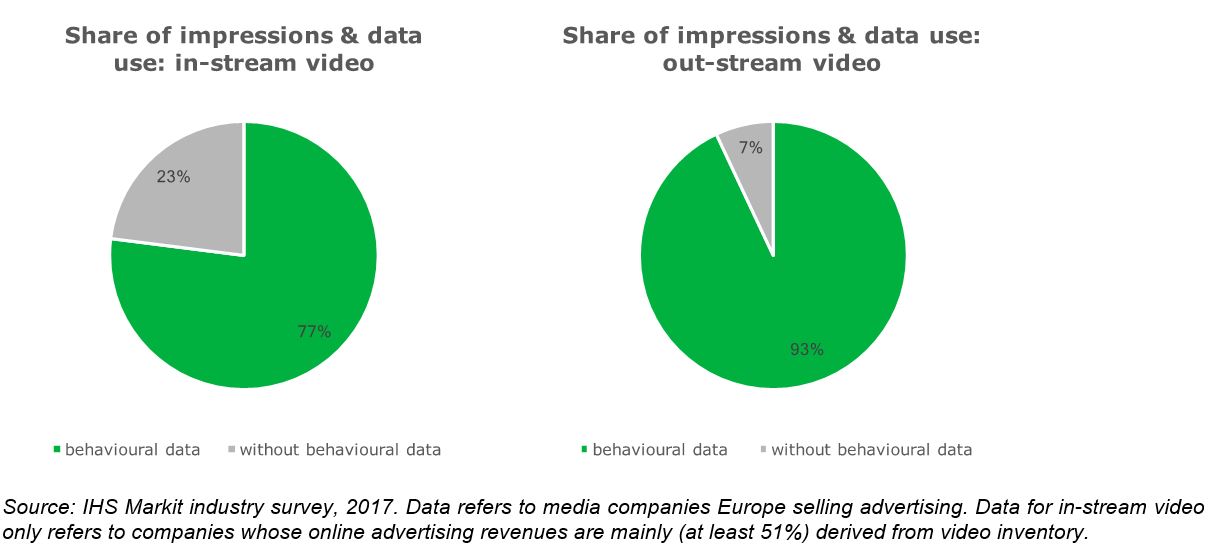

Triggering sales is not the only objective for digital advertising – and it is not the only objective to which behavioural targeting can contribute. Online video, in particular, is used as a vehicle for brand advertising that tells a story about a product without expecting a direct action from the viewer. Such campaigns also make frequent use of behavioural targeting. Media companies that generate at least 51% of their digital advertising revenue from video use targeting data for 77% of their in-stream video advertising impressions, on average. Targeting rates are lower (20%-30%) for media companies whose in-stream video business is not the primary revenue source. Out-stream video (video advertising not embedded in a piece of audio-visual content) has even higher targeting rates, with 93% of impressions being informed by targeting data (see Exhibit 3).

Exhibit 3: Video impressions

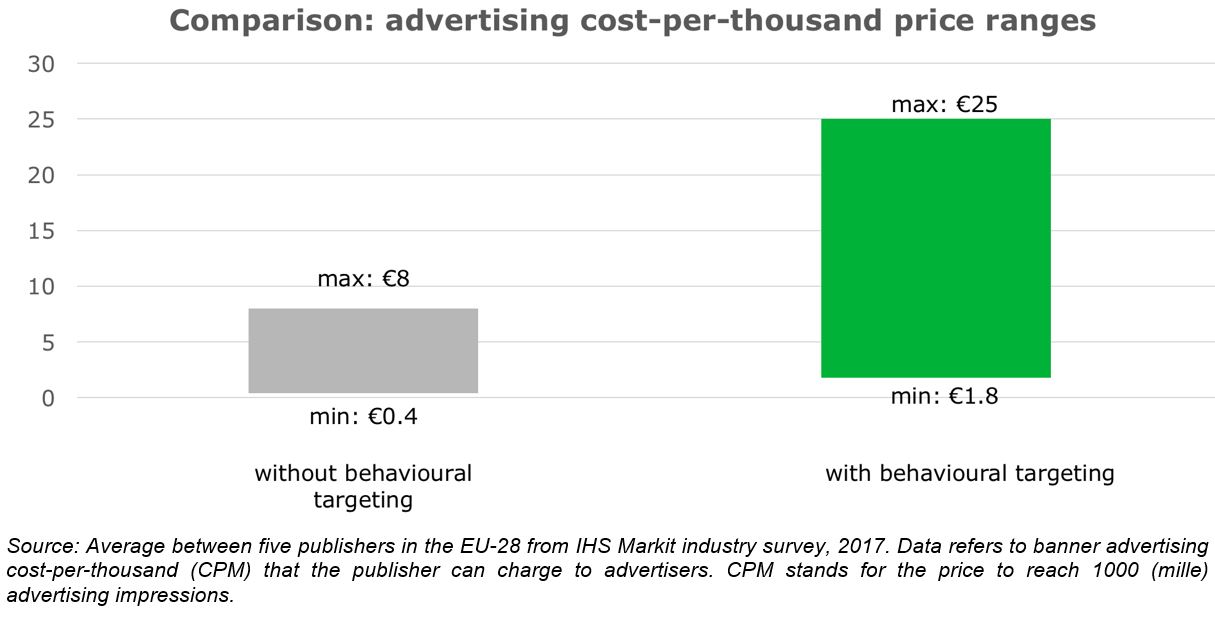

For media companies such as news websites, streaming platforms and TV broadcasters, behavioural targeting data generates revenue uplifts versus run-of-network advertising, which buys clicks or impressions without reference to behavioural data. This allow them to build more sustainable digital business models. For instance, media companies can use behavioural data to create custom audience segments (e.g. auto intenders) and better package their audiences to advertisers. This increases the value of their audience, while ensuring their advertising customers only pay for those audiences they want to reach (see Exhibit 4).

Exhibit 4: Cost-per-thousand uplift

3. What impact will the proposed ePrivacy Regulation have on digital advertising?

Behavioural targeting is more than a key driver just for digital advertising. Associated mechanisms such as programmatic advertising, and the expectations of effectiveness and efficiency, are also spilling over into other media, such as radio, out-of-home, Smart TV, and even linear TV. For instance, in leading European markets, behavioural data gleaned digitally already affects 20% of radio advertising spending. These trends mean that behavioural targeting is establishing itself as a new advertising paradigm across all other media. Advertising spend at large is becoming firmly reliant on the metrics, feedback, accountability and segmentation generated by behavioural data.

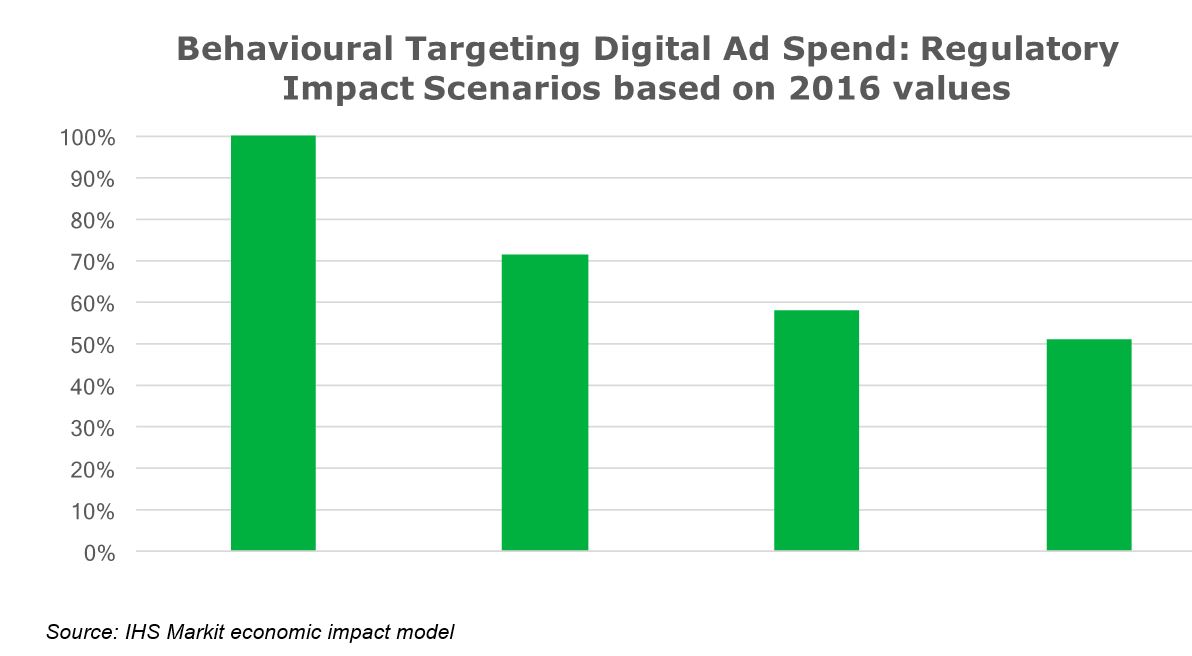

We have translated interviews with market participants into an economic impact model. It shows that the health of digital advertising is at material risk without behavioural targeting.

We used the model to generate three scenarios for the combined impact of the General Data Protection Regulation (GDPR) and the proposed ePrivacy Regulation on the digital advertising market as it stood in 2016, including current approaches to behavioural targeting:

- Scenario 1: low impact on market participants with large-scale 1st party data, 50% reduction of ad spend on publishers without sufficient data and scale to differentiate and provide accountability to advertisers. Some reallocation of digital ad spend to large-scale, data-rich market participants and to other media.

- Scenario 2: moderate impact on market participants with large-scale 1st party data, 70% reduction of ad spend on publishers without sufficient data and scale to differentiate and provide accountability to advertisers. No reallocation of digital ad spend to other digital market participants, some migration to other media and other regions outside of Europe.

- Scenario 3: 10% increase in impact on market participants with large-scale 1st party data, 70% reduction of ad spend on publishers without sufficient data and scale to differentiate and provide accountability to advertisers. Ad spend not reinvested.

In any of these scenarios, declines are not evenly distributed across market participants. We estimate that:

- publishers in the mid-and long-tail of digital advertising who are not in the top 50% of market size contributors, will, on average, see revenue contractions between 2x and 5x more pronounced than larger counterparts.

- publishers whose content and audiences are available through other publishers and sites will see revenue contractions 3x to 5.5x more pronounced than those whose content or audience scale makes them indispensable for advertisers.

Our model therefore suggests that barriers to behavioural targeting will negatively impact some types of market participants disproportionately. This leads to market concentration and affects the viability of digital advertising as a funding model for publishers.

The impact model above is based on the last available full year advertising market data (2016). However, an impact assessment therefore also needs to look at future market potential, and how it is affected by the proposed regulatory framework. Our analysis shows that the mid- and long-term impact of regulation will go beyond the values expressed in this model. Behavioural advertising is a high growth market, especially in the field of programmatic advertising, where the scale and granularity of behavioural data is particularly deep. Programmatic advertising constituted between 20% and 76% of digital advertising revenues in the EU markets in 2016, with an average of 41%. Extrapolating from the more advances US market, by 2020, this value would increase to 80%. As programmatic advertising matures, the market impact of regulation will grow over time because this market potential would not be realised.

We illustrate this below in a 2020 market forecast that assumes no regulatory changes, and apply the 2016 scenarios to it considering the growth potential of programmatic advertising.

Exhibit 6: Impact Model 2020

4. Methodology

This analysis was conducted by IHS Markit on behalf of IAB Europe and EDAA. It is based on a multi-method approach. A series of in-depth interviews and consultations was carried out with digital advertising market participants operating in the EU-28 (sample n=30). These include publishers, platforms, aggregators, advertising agencies, and technology providers. We used the principle of sample saturation, concluding field work when additional interviews and consultations did not yield any new insights. In order to obtain a picture across Europe, we considered feedback from countries with a mature digital advertising economy (high digital ad spend per capita) and emerging digital advertising markets (low digital ad spend per capita). The feedback and data provided in interviews and consultations were combined with IHS Markit’s proprietary database on advertising market trends, data collected from company filings, transaction data from behavioural advertising market participants and other third party sources. We cleaned and audited the data, mapped it against interview feedback and expressed it in an econometric model.

IHS Markit is a publicly owned company head-quartered in London, with over 13,000 employees based in over 30 countries throughout the world that offers information, analytics and expertise to organizations around the world. For further information, please contact Paul Alexander, IHS Markit: paul.alexander@ihsmarkit.com.