1. The Economic Contribution of Digital Advertising in Europe

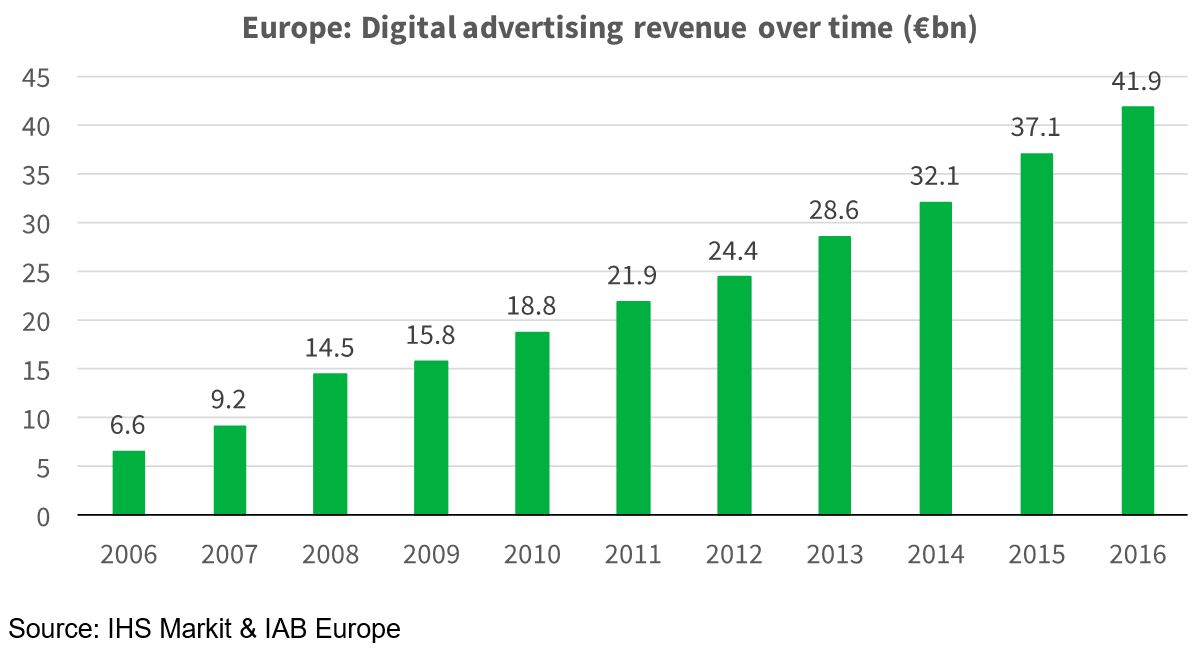

Over the last decades, media consumption behaviour of European citizens has undergone rapid change, with more time spent on digital media than ever before. In this context, online advertising as a pivotal funding model for digital content and services has transformed from a nascent industry with a marginal share of the total advertising market (1999: 0.5%) to the largest advertising medium in Europe attracting €41.9bn in 2016, or 37.2% of all advertising revenue. Between 2006 and 2016, digital advertising revenue has increased by over 530%.

Exhibit 1: Digital advertising

This proliferation of online advertising has wider positive effects on the development of the economy in Europe. Digital advertising contributes to the economy in a variety of ways. These include the contribution to employment and economic output, but also other, less direct impacts, such as supporting the development of the wider media, content, and online industries.

In 2015, we published a study that quantified the economic impact of digital advertising in Europe. This paper provides an update, considering how the further growth of digital advertising has extended its contribution to the economy. As our method relies on public records with are published with a delay, the 2015 study was based on 2013 data. In this update, we are able to draw on 2015 data for the analysis of economic contribution, and additionally on 2016 data to document the advertising reliance of key digital industries.

2. Measuring digital advertising’s economic contribution

We measure the economic contribution of digital advertising in terms of two main metrics:

- gross value added (GVA): a firm’s turnover minus what it pays its suppliers, which can be added up and whose total sum across the economy is roughly equivalent to the economy’s gross domestic product or GDP (GDP is equivalent to the sum of all industries’ GVA plus taxes minus subsidies).

- jobs created and enabled by digital advertising.

Advertising contributes to the economy in terms of GVA and jobs in several ways. We have grouped those effects into cumulative quantitative estimates to provide metrics for both narrower and wider measures of economic contribution (see Exhibit 2).

Exhibit 2: Taxonomy of economic contribution

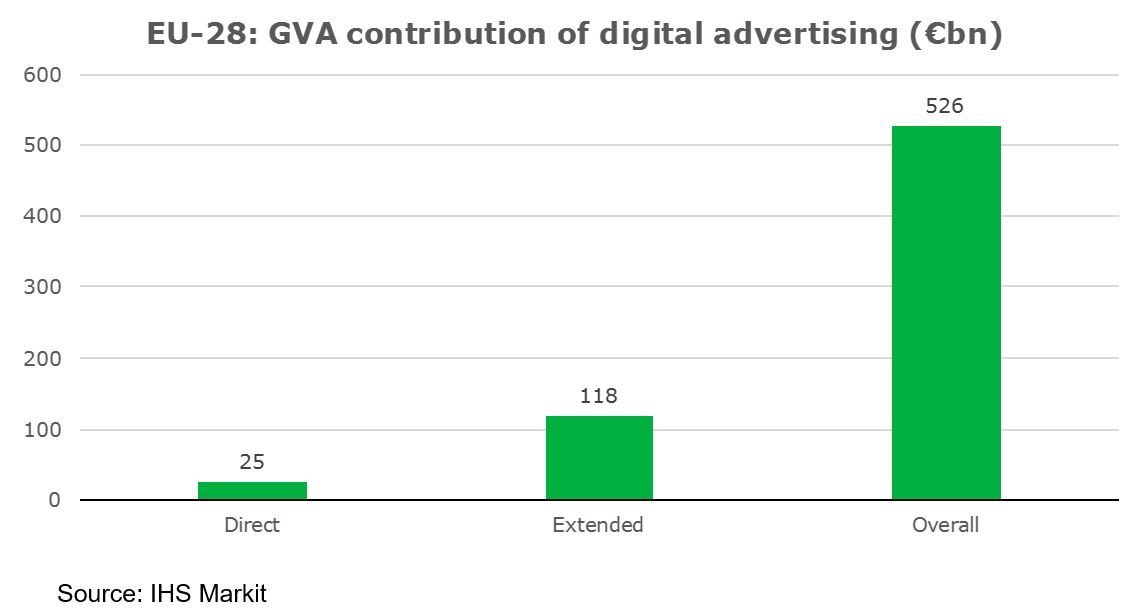

Based on this taxonomy, our research update found that the direct contribution of digital advertising to GVA in the EU-28 amounted to €25 billion in 2015. Taking into account indirect and induced effects, GVA contribution increased to €118 billion. Incorporating wider ripple effects to assess overall contribution showed a GVA value attributable to digital advertising of €526 billion (see Exhibit 3).

Exhibit 3: GVA contribution of digital advertising

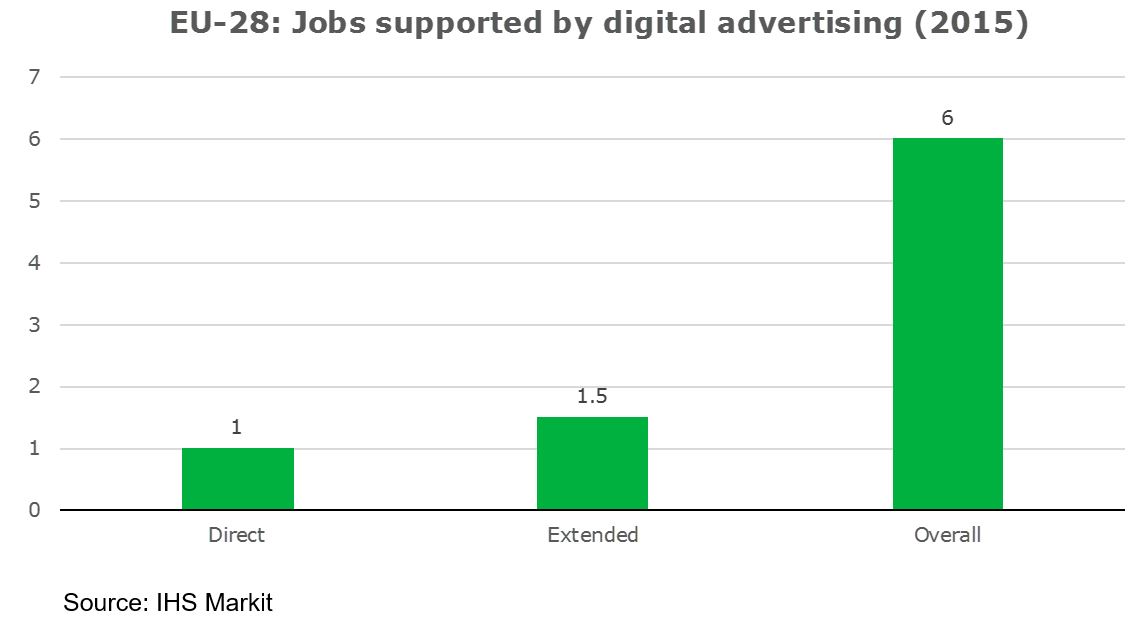

In terms of jobs, our update found that in 2015, 1 million jobs in the EU-28 were directly dependent on digital advertising in 2015. This increases to 1.5 million jobs if the wider industry supply chain is considered in a measure of extended contribution. If effects of advertising on increased sales and competition are taken into account, 6 million jobs in the EU-28 were supported by digital advertising (see Exhibit 4).

Exhibit 4: Jobs supported by digital advertising

Several trends conflate in this employment data. On the one hand, digital advertising produces economies of scale, which makes advertising more efficient, reducing the need for some types of jobs. On the other hand, digital advertising demands a range of highly fragmented specialisations, which increase the demand for jobs overall. These range from the creative production of advertising, the planning and buying of advertising, the measurement of advertising effectiveness, the sales and management of advertising inventory, to the production of this inventory through media content. Further specialisations include social media management, and dedicated experts for areas as diverse as banner, video, mobile advertising, as well as technical delivery and infrastructure. While the rapidly growing domain of data-driven and personalised advertising relies on a high degree of automation, this automation does not reduce the need for jobs. Instead, it produces the need for further specialists and generates additional volumes of work, such as in the fields of research and development of algorithmic systems, the management of those systems, and the production of more, bespoke creative advertising units for personalised delivery.

3. Advertising as enabler of digital business models

Beyond GVA and jobs, advertising contributes to the economy in other ways, notably in the domains of media and digital services. Key digital industries, such as publishing and the video and mobile sectors, rely on advertising as a revenue source to fund content, technology and labour.

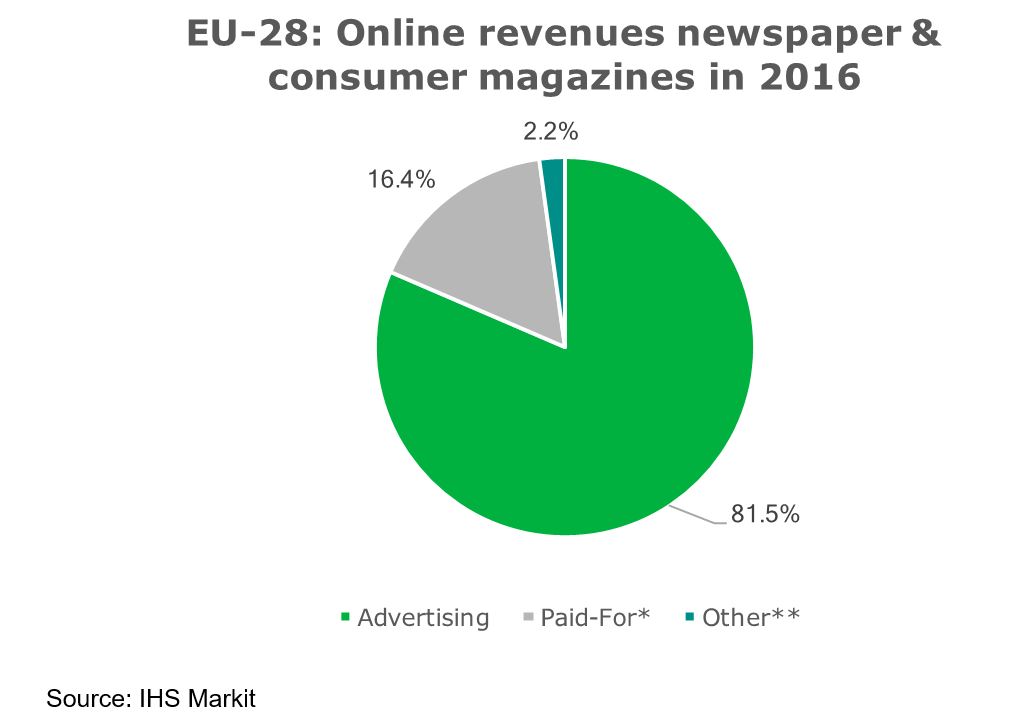

Newspapers and magazines increasingly see their future online, as media consumption habits shift. Advertising is the primary funding model that enables traditional newspaper and magazine publishers to succeed in a digital era, making up 81.5% of these companies’ digital revenues in 2016 in the EU-28. This figure excludes digitally native publishers, who do not have a legacy print business. We estimate that over 90% of these companies’ consumer revenues in the EU-28 stem from digital advertising.

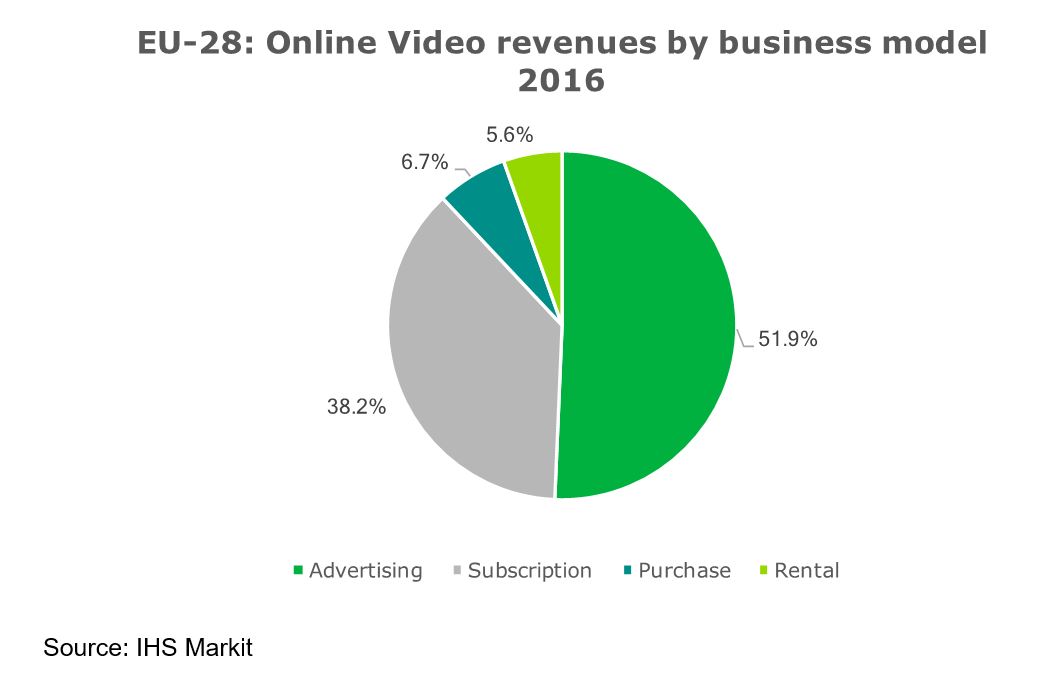

Exhibit 5: Online Video

Online video is a fast-growing sector as it combines the audio-visual storytelling potential of video with digital media as domains of media consumption. TV companies, publishers, and new market entrants alike are investing heavily in online video to capture the audiences of today and tomorrow. Advertising is the most important business model underpinning online video. In 2016, 51.9% of all video consumer revenues in the EU-28 came from advertising, while subscriptions made up 38.2% of revenues, purchases amounted to 6.7%, and rentals to 5.6% of total consumer revenues.

Exhibit 6: Newspaper & magazines

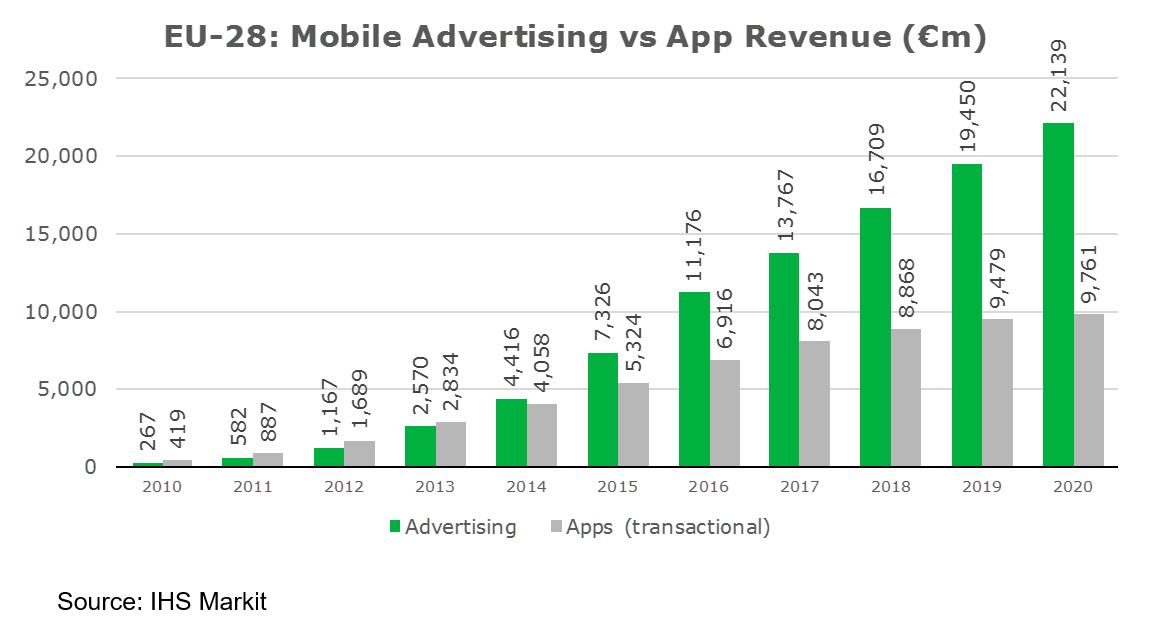

The mobile industry is undergoing a shift of funding sources, with advertising taking an increasingly dominant role. Mobile media content is monetised through advertising and transactional models, such as app or in-app purchases. Mobile advertising revenues in Europe amounted to €11bn in 2016 and will double to €22bn by 2020. The mobile media content industry is increasingly reliant on advertising as a funding source. While advertising revenues exceeded app revenues by the factor 1.6 in 2016, it will more than double app revenues to the factor 2.2 by 2020.

Exhibit 7: Mobile Content

4. Methodology

This research, conducted by IHS Markit on behalf of IAB Europe and EDAA, is a data update of our original 2015 study ‘Paving the way: how digital advertising enables the economy of the future’. The study constituted a first attempt to quantify the economic contribution of digital advertising to the EU economy. The foundational method was developed in the 2015 study, and we drew on newer datasets to produce more contemporary figures for this 2017 release.

Due to fragmented and incomplete data across Europe, an EU scope for such a study proved more complex than a single-country study, as undertaken previously in the US, or individual European countries. We conducted a meta-analysis of existing studies in Europe and the US to review assumptions, data sources and models. From these studies, we extracted common patterns such as multiples and ratios to create benchmarks for our own model. We incorporated these benchmarks into an econometric model that draws on GDP, employment data and other public data, as well as our proprietary database on advertising expenditure, to create by-country estimates for Europe. We cross-referenced these estimates with Eurostat data and local industry body data on advertising employment to validate and adjust them.

All our figures are subject not only to any potential limitations in the third-party estimates we have used, but also to the multiple assumptions we have made in applying these to an EU context. As can be seen, these considerations are particularly relevant to our economy-wide figures, which are meant only to illustrate rough orders of magnitude rather than actual estimates.

A full documentation of the method can be found in the appendix of our initial 2015 study (‘Paving the way’) referenced above.

IHS Markit is a publicly owned company head-quartered in London, with over 13,000 employees based in over 30 countries throughout the world that offers information, analytics and expertise to organizations around the world. For further information, please contact Paul Alexander, IHS Markit: paul.alexander@ihsmarkit.com.